How Do I Figure What the Salvage Value Is of 5959.00 in Furniture and Fixtures

Every few years, I go to the Apple store and turn my wallet upside down to become the newest iPhone. It'due south always a pleasant surprise when they hand me a couple of hundred dollars back to merchandise in my current 1.

Replacing business assets looks similar to getting a new iPhone. The money I get back on my former telephone is known as its salvage value, or its worth when I'm done using information technology.

Overview: What is relieve value?

Salvage value is an asset's estimated worth when it's no longer of employ to your business. Say your carnival business organisation owns an industrial cotton candy machine that costs y'all $1,000 new. At the end of its five-year service, you lot could sell it for $150. That $150 is its relieve value.

When businesses buy stock-still assets — mechanism, cars, or other equipment that lasts more than one yr — you need to consider its salvage value, besides chosen its residual value.

Generally Accepted Accounting Principles (GAAP) require accrual accounting method businesses to depreciate, or slowly expense over fourth dimension, fixed assets instead of booking one expense on the purchase engagement. Under nearly methods, you need to know an asset's salvage value to calculate depreciation.

Cash method businesses don't depreciate assets on their books since they track revenue and expenses every bit cash comes and goes. All the same, calculating salvage value helps all companies estimate how much coin they can expect to get out of the asset when its useful life expires.

Save value generally doesn't apply to tax depreciation. The Internal Acquirement Service (IRS) uses a proprietary depreciation method called the Modified Accelerated Toll Recovery Arrangement (MACRS), which does not incorporate save values.

However, MACRS does non utilise to intangible assets, or things of value that yous can't run across or touch on. Intangible assets are amortized using the straight-line method and commonly have no salvage value, pregnant they're worthless at the end of their useful lives. Talk to a tax accountant before calculating revenue enhancement depreciation.

How to make up one's mind an asset's save value

An asset's salvage value is its resale price at the end of its useful life. Follow these steps to determine your asset's relieve value.

1. Estimate the nugget's useful life

Useful life is the number of years your business plans to continue an nugget in service. It's only an estimate since your business may be able to keep using an nugget past its useful life without incident.

For tax purposes, the IRS dictates an nugget's useful life. If you're unsure of your asset's useful life for book purposes, you tin can't go incorrect following the useful lives laid out in the IRS Publication 946 Chapter 4.

ii. Notice similar assets in the market

Once you lot have the asset's useful life, take a look at the market for similar avails.

Say you lot've estimated your 2020 Hyundai Elantra to have a five-yr useful life, the standard for cars. Take a look at similarly equipped 2015 Hyundai Elantras on the market and average the selling prices.

Exist careful not to consider a similar asset'south asking price since, in near used-asset markets, things volition sell below their asking price. Go by the prices for which the assets sold.

You lot might learn through research that your asset will be worthless at the end of its useful life. If that'south the case, your salve value is $0, and that's perfectly acceptable.

How to calculate and tape depreciation with salve value

Once you've determined the nugget'south salvage value, you're set up to calculate depreciation. Follow these steps.

ane. Summate the asset purchase cost

Let's figure out how much you paid for the asset, including all depreciable costs. GAAP says to include sales tax and installation fees in an asset's purchase price.

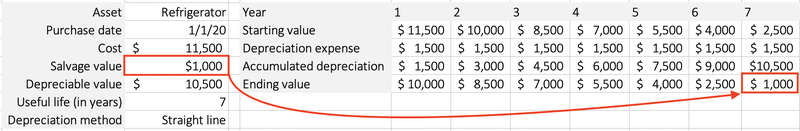

Say you ain a chocolate business that bought an industrial refrigerator to store all of your sugariness treats. You paid $10,000 for the fridge, $1,000 in sales tax, and $500 for installation. Therefore, your refrigerator's total purchase cost is $11,500.

$10,000 (Fridge) + $1,000 (Sales Tax) + $500 (Installation Fee) = $eleven,500

two. Find the depreciable value

The asset's depreciable value is the deviation between the purchase price and the salve value. Use the post-obit formula:

Asset Buy Price - Save Value = Depreciable Value

Say that a refrigerator'southward useful life is seven years, and seven-year-old industrial refrigerators go for $1,000 on average. The fridge'south depreciable value is $ten,500 ($eleven,500 purchase toll minus the $1,000 salvage value).

3. Choose a depreciation method

GAAP lets you choose your depreciation method. You must remain consistent with similar assets; if you have ii fridges, they can't exist on different depreciation methods.

You have 4 depreciation methods at your disposal:

- Straight line

- Double-declining balance

- Sum-of-the-years' digits

- Units of production

About businesses opt for the direct-line method, which recognizes a uniform depreciation expense over the asset'southward useful life. Even so, y'all may choose a depreciation method that roughly matches how the detail loses value over time.

For instance, the double-declining balance method suits new cars well since they tend to lose a significant amount of value in the first couple of years. Unlike the other methods, the double-failing residual method doesn't use salvage value in its calculation.

4. Create a depreciation schedule

Y'all're now ready to calculate depreciation for your fixed asset. Map out the nugget'due south monthly or annual depreciation by creating a depreciation schedule.

I'm going to use the direct-line method for the refrigerator. To summate annual depreciation with the direct-line method, apply this formula:

Depreciable Value ÷ Useful Life in Years = Annual Direct Line Depreciation

Annual directly line depreciation for the refrigerator is $i,500 ($ten,500 depreciable value ÷ seven-year useful life).

I recommend creating depreciation schedules using Microsoft Excel. By using a spreadsheet, you reduce the likelihood of arithmetic errors.

Use spreadsheet software to create your asset's depreciation schedule.

You know you've correctly calculated annual directly-line depreciation when the asset'south ending value is the salvage value. In the depreciation schedule higher up, the refrigerator'southward ending book value in year vii is $1,000, the same as the salvage value.

5. Prepare a depreciation periodical entry

At the cease of the accounting period — either a month, quarter, or year — record a depreciation journal entry.

The depreciation periodical entry accounts are the aforementioned every time — a debit to depreciation expense and a credit to accumulated depreciation. Hither's the annual journal entry for the fridge'south depreciation.

When yous're using direct-line depreciation, you can set upwards a recurring periodical entry in your bookkeeping software so you don't have to go in and manually prepare i every time.

2 best practices when using relieve values

Here are two tips to go along in mind when determining an nugget'southward salvage value.

1. Do market research to decide salvage value

Many concern owners don't put too much thought into an asset'due south salvage value. If you want the virtually accurate books possible — and I know you lot exercise — spend some time looking at the market for similar assets that recently sold in a condition similar to your asset at the cease of its useful life.

The Financial Accounting Standards Board (FASB) recommends using "level ane" inputs to detect the fair value of an asset. In other words, the best identify to detect an asset'southward market value is where similar appurtenances are sold, or where you tin can get the best price for information technology.

For example, you probably wouldn't go to eBay to sell a slice of fine jewelry. Y'all'd go to a trusted jeweler who knows how much similar jewelry sells for in stores.

2. Don't be afraid of no salvage value

Some assets are truly worthless when they're no longer of use to your business. If at that place'southward no resale market place for your nugget, information technology likely has a zero salvage value.

You might have designed the asset to take no value at the terminate of its useful life. Perhaps you lot hyper-customized a motorcar to the point where nobody would want it once y'all're through with it. Even some intangible assets, such equally patents, lose all worth once they expire.

You can still summate depreciation without a salvage value; just put a $0 in whatever identify where you demand to enter a relieve value.

Salvage your accounting

Ane of the starting time things you should exercise after purchasing a depreciable asset is to create a depreciation schedule. Through that process, you lot're forced to make up one's mind the asset's useful life, salvage value, and depreciation method.

You lot desire your bookkeeping records to reflect the true condition of your business concern'southward finances, so don't wait until tax season to start thinking about depreciation.

0 Response to "How Do I Figure What the Salvage Value Is of 5959.00 in Furniture and Fixtures"

Post a Comment